The Direct Selling Capital Advisors Direct Selling Index (DSCI) fell 8.4 percent in August, the second consecutive noticeable decline and the index’s weakest monthly performance since March 1, 2020. The Dow Jones Industrial Average (DJIA), by contrast, rose over the last two months, increasing 1.9 percent in August and 1.3 percent in July.

In August, three members of the DSCI fell by double-digit percentage points—Medifast, Inc. (NYSE: MED); The Beachbody Company, Inc. (NYSE: BODY); and Sharing Services Global Corporation (OTC: SHRG)—and an equal number increased by more than 10 percent–eXp World Holdings, Inc. (NASDAQ: EXPI); Tupperware Brands Corporation (NYSE: TUP); and Mannatech, Inc. (NASDAQ: MTEX). Surprisingly, BODY and SHRG were among the stocks that also declined by more than 10 percent in July.

In total, 11 of the 17 stocks in the DSCI lost value during August, including seven of the eight small-cap stocks.

Since the DSCI tracking period began in March 2020, the DSCI has gained a cumulative 82.8 percent, compared to the DJIA’s gain of 35.9 percent. Year-to-date, the DSCI has increased 15.7 percent, while the DJIA has gained 14.2 percent.

The DSCI’s disappointing performance over the last two months essentially erases the outsized gains realized over the previous two months, particularly the 18.4 percent increase in May.

“An issue facing the direct selling stocks, and likely a principal reason for the pronounced declines in the DSCI over the last two months, has been investors’ increasing focus on large cap stocks, particularly mega-cap technology stocks, and the resultant narrowing of the group of advancing stocks,” said Stuart Johnson, Direct Selling Capital Advisors CEO. “These giant stocks are heavily represented in the DJIA and account for a continuation of that index’s rise over recent months. Conversely, many direct selling stocks are small to mid-caps and have been a source of funds for investors recently. As an illustration of this current preference for larger cap stocks, it is likely no coincidence that five of the nine large cap components of the DSCI increased in August, while only one of the eight small cap members gained.”

It seems possible that the significant declines experienced in July and August will be at least partially reversed in September and, factoring in strong earnings reports and the declines in share prices of many of the stocks over the last 60 days, many direct selling stocks currently trade at substantial P/E discounts to the overall stock market. HLF stock, for instance, already increased 3 percent in the first three days of September, without any company-specific news.

With this in mind, however, September is historically a difficult month for overall stock market performance. It is also when investors will be grappling with the delicate issues of the timing of the U.S. Fed’s potential tapering of its bond buying program, and the details of any tax increase plan to fund increased federal spending.

Large Cap Stocks

- Betterware de Mexico (NASDAQ: BWMX) fell 0.5 percent in August despite reporting healthy second quarter earnings on August 5. Revenue, EBITDA and net income increased 81 percent, 92 percent and 72 percent, respectively, over the previous year. Shares are up 27.2 percent since the start of the year and a remarkable 349 percent since BWMX began trading in March 2020 after the company’s merger with the SPAC DD3 Acquisition Corp.

- Tupperware Brands Corporation (NYSE: TUP) reversed its downward pattern that has lasted several months, increasing 14.3 percent in August, and cutting its year-to-date losses to 25.3 percent. Since March 1, 2020, TUP shares have gained an astounding 737.5 percent. On August 4, the company reported second quarter results that easily surpassed Wall Street’s expectations. Quarterly net sales and adjusted EBITDA each increased 17 percent compared to the previous year. In late June 2021, TUP’s Board of Directors authorized a $250 million stock repurchase plan, equivalent to 20-25 percent of shares outstanding, reasoning that the company’s Turnaround Plan had successfully improved its liquidity position.

- Nu Skin Enterprises, Inc. (NYSE: NUS) shares declined 5.7 percent in August, leading shares to be down by 7.3 percent in the first eight months of 2021, but up 114.6 percent since March 2020, when tracking began. Second quarter earnings included an increase in revenue by 15 percent over the previous year’s period, and EPS growth of 42 percent. NUS boosted its full-year 2021 EPS guidance to $4.30-$4.50, about a 5 percent increase from the guidance it issued just three months before.

- Herbalife Nutrition, Inc. (NYSE: HLF) gained 0.8 percent in August, boosting the stock’s year-to-date performance to 2.9 percent, and a gain of 58.7 percent since March 2020. Second quarter net sales reached $1.6 billion, up 15 percent from a year ago, and adjusted EBITDA rose even more rapidly, reaching $262 million, 18 percent higher than the second quarter of 2020.

- Medifast, Inc. (NYSE: MED) stock was the victim of significant profit taking in August. The company’s second quarter revenues increased 79 percent from the same period last year, and diluted EPS grew even faster, reaching $3.96 in 2Q 2021, up 113 percent. In turn, MED boosted its full-year 2021 revenue guidance slightly to $1.425-$1.475 billion. However, despite these robust numbers, MED’s shares declined a remarkable 20.2 percent in the month, cutting its gains since March 1, 2020 to 186.7 percent. Based on the $13.44 per share midpoint of MED’s annual earnings guidance, the stock trades at a P/E multiple of about 17.5x, an approximate 20 percent discount to the overall stock market’s valuation, despite its much faster projected revenue growth.

- USANA Health Sciences, Inc. (NYSE: USNA) shares rose 1.8 percent in August, leading to a year-to-date gain of 24.5 percent. Since the March 2020 inception of the DSCI, USANA shares have increased 46.8 percent, beating the Dow’s 35.9% cumulative price increase. USANA reported robust second quarter results, with net sales and diluted earnings per share jumping 30.1 percent and 41.7 percent, respectively, from year ago levels.

- eXp World Holdings, Inc. (NASDAQ: EXPI) shares posted the strongest performance of all DSCI members in August, rising 27.6 percent. So far in 2021, the stock has climbed 49.4 percent, and an astonishing 859.2 percent since March 2020. Second quarter financial results reported 87 percent more agents than in the year-ago period. Equally important, EXPI declared a $0.04 per share quarterly cash dividend to shareholders, its first-ever dividend. Its cash balance increased $44 million in the quarter, even after repurchasing $55 million of stock during this period. The company announced on August 31 that it has expanded into Germany, bringing the total number of countries and territories in which its real estate agents operate to 18. EXPI now employs more than 62,000 agents across the globe.

- Primerica, Inc. (NYSE: PRI) was the fourth-best performer among all stocks in the DSCI in August, rising 4.6 percent, and is now 18.5 percent higher over the first eight months of 2021, and 39.6 percent higher since the March 2020 inception of the DSCI. The company’s second quarter revenue and earnings per diluted share increased 25 percent and 28 percent, respectively. PRI’s ROE is an impressive 26.3 percent.

- The Beachbody Company, Inc. (NYSE: BODY) stock declined 13.9 percent in August. Second quarter revenue increased 2 percent versus over the same period in 2020, and digital revenue rose 20 percent. Adjusted EBITDA was negative $4.4 million in the second quarter versus positive $0.9 million in the second quarter of 2020.

Small Cap Stocks

The small cap stocks tracking set lagged noticeably behind the performance of their large cap peers in August, with seven of the eight stocks falling during the month. Mannatech, Incorporated (NASDAQ: MTEX) was the second-best performer of all DSCI components in August, rising 27.1 percent. The stock has appreciated 81.8 percent over the first eight months of 2021 and reported solid second quarter financial results, including a 12.9 percent increase in revenues over the second quarter of the previous year. Diluted EPS reached $0.99 in the quarter, a 111 percent increase from $0.47 in 2020.

Short Interest and Data Analysis

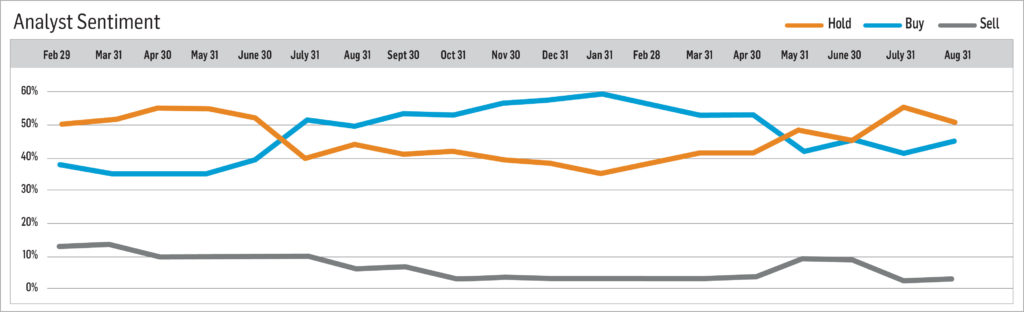

Short interest in industry stocks continued to move higher through mid-August, and “days to cover” has increased about 150 percent since bottoming in mid-February. The number of sell-side analysts maintaining “buy” and “hold” ratings on industry stocks was around 97%. The percentage of stocks which analysts recommended selling was only 3 percent.

Analysis brought to you by:

Direct Selling Capital Advisors provides monthly market analysis abased on research and the TDSI index. The TDSI is a market capitalization weighted index of all domestic public direct selling companies with a market capitalization of at least $25 million.