Judge demands more evidence in case against FES.

In recent years, the Federal Trade Commission (FTC) has increasingly targeted companies in the direct selling space, pursuing claims of emphasizing recruitment over product sales and questioning the legality of compensation plans. While the channel has been diligent about defending itself against the allegations and impacted companies have shown remarkable resolve and flexibility in finding actionable remedies to the concerns, the power of the FTC has made it difficult to find resolution.

It’s a frustrating situation that has many executives in the channel concerned. The power of the FTC is undeniable, and by putting the industry in its crosshairs, it has compelled many companies in the channel to explore new compensation plans and double down on product sales and customer acquisition efforts. These are welcome changes and have helped to modernize and legitimize the channel in the minds of many.

Unfortunately, these changes haven’t alleviated the intensity of FTC scrutiny. But a recent ruling in a case may have signaled a change, at least in the judiciary, to help level the playing field.

At a preliminary injunction hearing June 30th in the U.S. District Court for the Eastern District of Michigan, federal district court judge Bernard A. Friedman required the FTC to provide more evidence in its case against Financial Education Services (FES). FES is a direct selling company that offers credit restoration services, wills and living trusts among other services. The FTC had levied pyramid scheme charges against FES a month prior.

The judge also reversed his own temporary restraining order issued a day after the FTC filed its complaint, essentially terminating an asset freeze and allowing FES to continue operating.

A First for this Industry

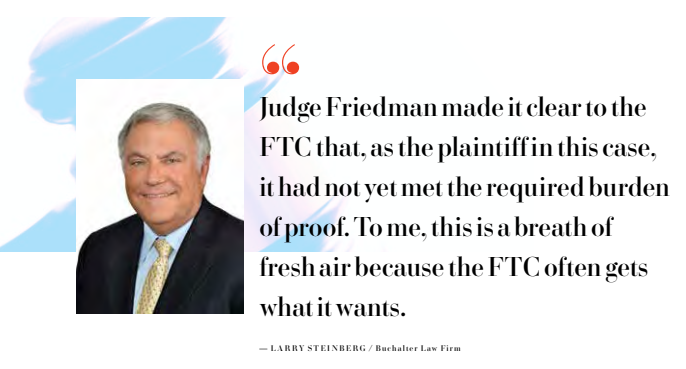

Larry Steinberg, chair of the Buchalter law firm’s MLM industry group, who was legal counsel for BurnLounge in its landmark 2007 case with the FTC, was surprised when he heard that the judge in this case rescinded his own order and asked the FTC to come back with more evidence. “This is the first time to my knowledge where the FTC lost the entirety of its preliminary injunction motion, and lifted an asset freeze that had been entered entered on an ex parte emergency basis at the beginning of the case.”

In this case, the court initially did what was expected: issued an asset freeze order as well as installed a Receiver to run the company. But the fact that FES was allowed to re-open its doors 30 days later once the judge lifted the asset freeze and changed the Receiver to a Monitor is a departure and a positive development for the channel.

“Usually, when the FTC brings a case to court, the judge gives it the benefit of the doubt,” said Steinberg. “A judge will assume that if the company in question was a legitimate, law-abiding business, the FTC wouldn’t be there wasting its time and resources.”

Why is this such a departure? Because historically, the judiciary has deferred to the FTC in direct selling litigation. This might be because the complexity of the business model is confusing. But in this instance, the judge did not do that. “Judge Friedman made it clear to the FTC that as the plaintiff in this case, it had not yet met the required burden of proof. To me, this is a breath of fresh air because the FTC often gets what it wants,” shared Steinberg.

Steinberg did note that the court certainly is allowing for the possibility that the FTC will come back with more evidence. But for now, this judge denied the preliminary injunction and lifted the asset freeze, not because it was validating the legality of FES’ business model—the court didn’t go that far—but because, without any actual evidence, the FTC had not, as yet, met its burden of proof.

So, What Led to the Judge’s Decision?

After reviewing the June 30th preliminary injunction hearing transcript, it appears that FES’ legal team made a compelling argument that the FTC failed to provide sufficient evidence and show adequate due diligence, leading to the judge’s decision.

Richard W. Epstein, a partner at Greenspoon Marder LLP and legal counsel for FES, successfully argued that, since the FTC provided no FES operational data in its complaint, the court could not make the required finding that FES emphasized the recruitment of agents over the sale of products.

According to Epstein, what the FTC did provide was a lot of bank records. But bank records only show money coming in and out. “It doesn’t tell them whether this is from customers buying the product, which would indicate that this is a legitimate multi-level marketing plan, versus money coming from the sale of the business opportunity, which is one element of a pyramid scheme.”

Continuing, Epstein went on to state that out of FES’ 160,000-plus agents and roughly 420,000 customers the company has serviced, to say in broad-sweeping terms that this company operates as a pyramid scheme is a stretch. “Without taking into account the actual data that exists that could have allowed for an appropriate evaluation of the marketing plan, there simply is not a proper foundation to continue any sort of injunctive relief against any of the corporate parties in this action.”

FES Brings in Third Party to Review FTC Complaint

To further analyze the FTC’s complaint against FES, Epstein asked Branko Jovanovic, Ph.D., principal with The Brattle Group, an international economic consulting firm with extensive experience analyzing MLM compensation models, to give his opinion on the allegations regarding FES’ product offerings. “As Dr. Jovanovic points out in our expert rebuttal to Dr. Givens, there is no set standard. There is no bright line that anyone has drawn… and more importantly, the Federal Trade Commission has not drawn,” Epstein asserted.

Here is a short breakdown of Dr. Jovanovic’s analysis of the FTC complaint:

Credit Repair Products are Ineffective

The FTC focused on a small subset of three products that they stated were ineffective. However, FES’ restoration services have led to a removal of 500,000 obsolete, unverifiable and inaccurate items in customer credit records from 2019 to 2021.

No Evidence of What Defines a Pyramid Scheme

Rather than defining what a pyramid scheme is (or isn’t), Dr. Givens’ declaration simply asserts that FES is one. However, his conclusions that FES’ compensation plan incentivizes recruitment over retailing; that the majority of agents start at the lowest rank inherently implies that FES operate a pyramid scheme; and that there is no return policy are all demonstrably wrong.

No Access to Distributor Level intelligence Data

Because of constraints imposed by the Receiver, Givens’ and Jovanovic’s decisions were reached without direct access to important data that would have provided more clarity.

Judge Friedman’s Final Take

When it came time for Judge Friedman’s ruling he stated that as he was listening to the arguments, he was looking for a preponderance of evidence standard to base his ruling on. But all he had were pleadings and affidavits that are disputed. “Pleadings, as we all know, are not evidence,” said Friedman. When it comes to the public interest, the judge said we must do all we can to enforce regulations and laws to protect consumers, but we also need to protect businesses. “…we also have a public interest in promoting entrepreneurial endeavors and we have (a) public interest in allowing people to conduct their business in a lawful manner.” He presumed FES would continue to operate lawfully because “everyone’s going to be watching.”

What We’ve Learned So Far

This case is just getting started, and a lot can and will happen in the months and years to come as this case heads to court. But here are a few things we can glean from this case so far that could have ramifications moving forward.

The FTC Must Substantiate Its Claims

The agency can no longer assume judges will rubber stamp their complaints. This has been the major grievance of many companies who get caught in the crosshairs of the FTC—that the agency doesn’t have substantial evidence to file its complaint.

The FTC Hung their Hat on Section 13(b)

Since the early 1970s the FTC has used Section 13(b) to claim and obtain extraordinary monetary relief, such as freezing a company’s assets. After a unanimous ruling in April of 2021, the Supreme Court, in AMG Capital Management vs Federal Trade Commission, ruled that Section 13(b) does not authorize the Commission to obtain court-ordered monetary relief. That is exactly what Mr. Epstein argued that the only basis cited in the temporary restraining order for the asset freeze was “rescission or reformation of contracts and refund of monies or property. This is monetary relief.”

Judge Friedman Did What Judges Should Do

He listened to both sides, read everything carefully and said that, with no substantial evidence provided, the FTC had not met its burden.

A Game-Changing Moment?

“This lawsuit has the potential to be groundbreaking when it comes to MLM and pyramid scheme litigation,” Steinberg said. “Only time will tell. With the injunction phase of this case behind us, FES is able to continue in its business for now. Right now, the parties are getting into discovery and motion preparation. I will be following this case very closely.”

We all appreciate having our rights as a consumer protected. That is what the FTC is for. But businesses also need protection from government overreach. The damage that ensues from an FTC investigation can be devastating and far reaching, as many companies in the channel can attest to. We can only hope all judges follow Judge Friedman’s lead and base their decisions on the evidence. That’s all that anyone can ask for.

FTC VS FES Timeline of Events

May 23, 2022

FTC files a complaint alleging that FES and its owners, Parimal Naik, Michael Toloff, Christopher Toloff and Gerald Thompson, as well as a number of its related companies, bilked consumers for more than $213 million, including operating an unlawful credit repair scam that has deceived consumers across the country, and alleging that FES’ investment opportunity is an illegal pyramid scheme.

The FTC included a declaration from Dr. David Givens, an economist in the Consumer Protection Division of the Bureau of Economics at the FTC, to support its claim that the company was operating as a pyramid scheme, although Givens never saw any company data. He said that the FES information given to him by the FTC was consistent with being a pyramid scheme.

May 24, 2022

Judge Bernard A. Friedman, a federal district court judge for the Eastern District of Michigan, issues a temporary restraining order essentially shutting down the company and freezing all of its assets.

June 30, 2022

After hearing oral arguments from both sides, Judge Friedman issues an order denying the FTC’s motion for preliminary injunction, vacating the temporary restraining order, terminating the previously ordered asset freeze and converting the receivership to a monitorship.

From the November 2022 issue of Direct Selling News magazine.