How Gen X, Millennials & Gen Z really feel about direct selling.

A first-of-its-kind study details how every generation of Americans across all genders, geographies and socio-economic levels perceive, engage with and measure success and opportunity in direct selling.

Times have changed, but in the direct selling channel executives can easily assume (read: hope) that some things never will.

That belief was challenged last year when Jason Dorsey, President of the Center for Generational Kinetics (CGK), presented his generational research at Direct Selling University. Generational research identifies differences between generations in underlying motivation, actions, behavior and predictable tendencies. And while his findings illustrated how deeply the generational divide impacts how people perceive and engage with the world around them and detailed how companies cannot simply rely on one messaging style to effectively reach all ages, all the insights were borrowed from research done in other industries. As I dug deeper into this game-changing topic, I quickly discovered that no generational study of any significance had ever been done just for the direct selling industry.

As a (ahem) seasoned executive and the founder of Bridgehead Collective, a firm founded to help companies in the channel innovate, form and execute strategic plans in a dynamic digital environment, I know the importance of well-researched data. Operators at our core, we use data to help companies maximize every dollar spent. Data is the foundation for determining how to allocate investments; where to leverage human power to lead through change; how to identify and overcome internal and external obstacles to growth; and how to decide which strategies will have the most robust impact on measurable results. That’s why, as I listened to Jason, I knew that we needed to harness the power of original generational research in a way that would specifically analyze the direct selling industry. If we want answers that we’re willing to dedicate all our resources towards, then we must do the research. As much as we’d like to think we’ve been around long enough to have all the answers, we often need to reach out to those who actually do.

New Generation-Specific Strategies

In a first-of-its-kind study, Bridgehead Collective chose to partner with the Center for Generational Kinetics, which has led more than 100 research studies in all major industries. Their seminal annual study, The State of Gen Z, formed the basis for the best-selling book, ZConomy and has been consistently featured in national and global media including The Wall Street Journal, New York Times, CNN and many more. I set out to discover America’s perceptions of entrepreneurship, the gig-economy and, more pointedly, direct selling. Statistical significance was of ultimate importance in this analysis, so the study represents a wide-sweeping sample that is reflective of America, with an equitable mix of genders, demographics, employment status, education levels and location that allows for a 97 percent confidence level.

When we launched the study, my biggest fear was that I would spend a year immersed in this process, only to resurface with findings that were predictable. I anticipated a year full of “Well, as we suspected…” but instead, I was thrilled by the differentiated and potentially game-changing nature of our results, and I think you will be too.

We designed the study to provide Actionable Insights across 10 Key Categories:

- Perception of Industry and Channel

- Recruiting and Prospecting

- Motivations and Decision Criteria

- Onboarding and Getting Started

- Training

- Compensation and Value Proposition

- Recognition

- Incentive Trips and Events

- Retention

- Duplication and Role of Team Building

What did we learn? So, so much! Every generation has strong feelings about how we recruit, onboard and train. That maybe we knew. But no two generations are remotely the same in what motivates them to want to stay in or leave a business. In fact, as we looked at the data, it was common to see results that were significantly polarized. Each of these 10 key categories provided new, actionable insights that every marketing, sales, field communication and compensation team will want to design around. Following are just a few of these standout insights from one of those categories.

Leading with a one-size-fits-all approach is from a bygone era; I don’t think anyone is still stuck in that model. But many companies are still relying on a historical positioning of the direct selling opportunity that doesn’t really fit anymore. We must consider just how much perceptions have shifted and strategize with generational chasms in mind.

What we need is a new roadmap.

Precision Messaging

It’s common to hear direct selling executives and field leaders say they are eager to pursue Gen Z. They are the next generation of customers, after all, and represent the threshold to what’s next. In an effort to court the youngest shoppers, however, brands can jump on trend bandwagons that have the opposite effect for older generations, effectively alienating their already loyal customers and distributors in the Gen X and Millennial age brackets.

The key, then, is to deliver our messages with precision. No two generations have the same preferences, experiences and motivations, so our messaging shouldn’t either. We need to become students of generational divides, knowing how to fine-tune our communications so that they speak the language of each specific customer and what our sellers want to be called for maximum credibility (Spoiler alert: it’s not Ambassador).

This will create the trust we need with each generation to ensure our messages are heard, understood and embraced. With the right data, it’s possible to truly reach everyone by refining our audience and tailoring our messages for maximum impact.

The Sweet Spot of Opportunity

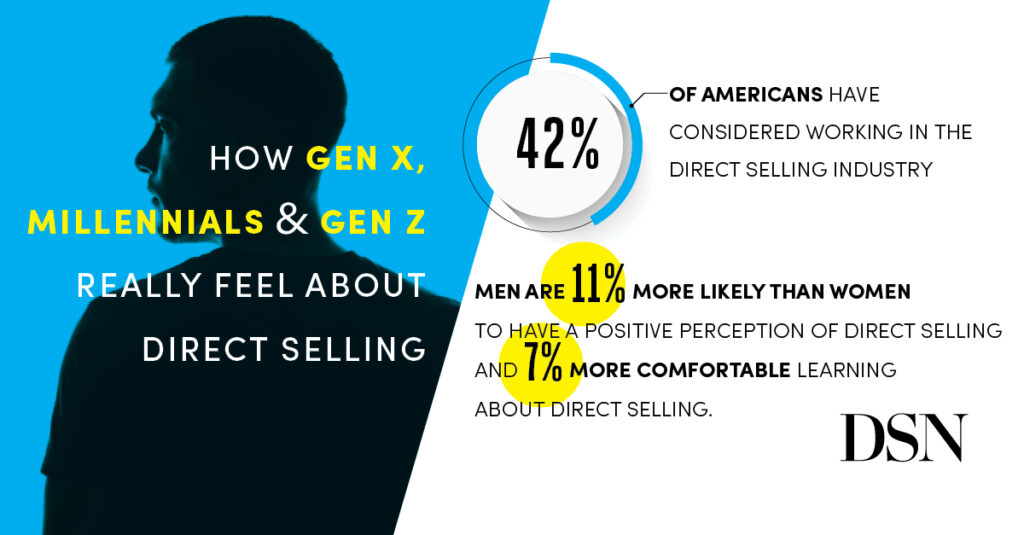

The good news is, across the board, Americans are generally interested in starting their own business. Even better, a whopping 42 percent have considered working in the direct selling industry. If we stopped there, we might be misled to think that a large segment of every generation is ready to receive the direct selling opportunity without reservation.

When we dig deeper, we find that Gen Z (ages 18-26) and younger Millennials (ages 27-35) are significantly more likely than older generations to be working or to have considered working in the direct selling industry. However, older Millennials (36-43) and Gen X (44-55) are much more likely than their younger counterparts to have never considered working in the direct selling industry.

In fact, the study told us that younger generations, especially younger Millennials, not only have a significantly more positive perception of direct selling compared to their older counterparts, they’re also considerably more comfortable learning about the opportunities it can offer.

From this survey question, another statistic was buried within the data that took us by surprise: men are 11 percent more likely than women to have a positive perception of direct selling and seven percent more comfortable learning about a direct selling opportunity.

For years, many direct selling brands have spent their energy courting Gen Z women shoppers and mom-preneurs, but the data is telling us that Young Millennial men, ages 27 to 35, are potentially our biggest missed opportunity.

If we use precision messaging, we can advance recruiting in this demographic while also tailoring our communications with the older, more skeptical demographic in a way that speaks to their doubts and concerns.

Barriers by Generation

Being an entrepreneur is no easy task, so it’s no surprise that high startup costs (54%) and failure itself (46%) are the biggest barriers Americans face when considering a new business venture. But those challenges increase as we step into the direct selling genre.

Taking all ages into account, 46 percent of Americans who have a negative perception of direct selling just have a general belief that the industry is a scam or predatory, and 43 percent are convinced they would have to get their friends to buy something in order for them to be successful.

These are big numbers that represent big barriers for any prospective distributor or customer. How can we reposition our messages to assuage these beliefs?

By digging into the data. Our study exposed exactly what words to use to overcome these barriers; how to position the opportunity; where and how to reach them; and the most effective language to use for each generation.

Once we’ve addressed these gateway obstacles, we need to consider how Americans want to be approached with the opportunity. Most generations prefer an in-person conversation with a family member or friend—surprisingly, 70 percent or more of Gen Z and all Millennials favor this method.

What no generation preferred was a group discussion led by a distributor. Group meetings, whether on Zoom, at an event or in a coffee shop, scored low across the board. There was one caveat: Younger Millennials were the most receptive of all generations across a number of categories and approaches.

This was one of the most surprising insights from the entire study. Younger Millennials don’t really care where or how they learn about direct selling. They simply want to hear about it, even more than we might have thought.

What’s Their Win?

Making extra money is by far the biggest benefit Americans seek when getting involved as a direct selling distributor. From there, having control over when and where work happens (43%) was a strong driver.

For older generations, getting paid weekly significantly influences their likelihood of engaging in the direct selling industry, while younger generations prioritize learning new skills that can be used in their daily lives and building their influence and impact.

Money is the best and most welcomed benefit by a long shot, and getting paid and receiving money is what makes people want to stay working in the industry. In fact, it’s the highest predictor of whether or not an American would choose to keep working their business after the first three months.

While this is obvious, there is more to the story. In a generation-specific analysis, we see that Gen Z is also deeply impacted by a belief that they are part of a cause or movement, and that helping at least three other people get started would absolutely convince them to stay at a direct selling business after the first three months, significantly more so than older generations. For Gen X, it’s all about getting paid and seeing the product or service they’re selling work in their own life.

How Much Is Enough?

We have all been reframing our business opportunity in increasingly compliant ways, referring to “extra or additional or supplemental income” instead of a specific dollar or some other atypical earnings amount. The problem though is that this general approach to pitching opportunity will mean different things to different people. However, now, with this research, we know for the first time how much money “additional or extra or supplemental” income really is. An extra $500 a month is enough for 83 percent of Americans to say they would get involved in direct selling, but the exact amounts vary significantly by generation. For older generations, $1,000 or more in the first month convinces them that direct selling is worth it. For younger generations, that number is only $250-$499 and the mention of more than $1,000 can raise red “ick-factor” flags that will deter them from ever joining! We have the data to show you why.

Much to my surprise, cash bonuses for hitting certain sales thresholds beat out a simple consistent selling percentage as the number one preferred performance incentive across the board. In contrast to Gen X and older Millennials, younger generations valued recognition in front of their peers or at a national or international meeting as a highly effective performance incentive.

It’s important to take note that respondents rated some of the most common industry recognition tools as the least likely to make them feel valued as a distributor, which when armed with this data, should have some of you rethinking how you recognize on social or those increasingly ubiquitous give-back trips.

Unlock Untapped Opportunity

The study clearly shows us that generations perceive this industry in vastly different ways than we may have thought.

The often-touted homogeneous, funnel marketing technique may appear more efficient, but this study proves that it is likely also less effective. We must balance efficiency with effectiveness. When we think about investment, we need to also think about changing the lens with which we’re viewing that investment. What’s a bigger spend: one cheaper, ineffective communication approach or a multi-pronged message that may cost more but delivers results?

For instance, if you want to go after younger Millennials, talk about the opportunity to earn an extra $250 a month and offer them a trusted guide to help them develop the skills they need. If you want to go after Gen X, focus on the potential to earn an extra $1,000 a month and the efficacy of your products.

There are wide bands of Americans that genuinely want and are looking for what we have to offer. All of the insights above were from just one of the 10 categories of questions, and they all offer equally insightful and actionable data we can apply to every facet of our businesses. When we fine-tune our target market and let the data guide our message there is vast opportunity waiting to be unlocked.

Want to learn more? Join us at the DSN Deep Dive event happening Friday, May 19 in Flower Mound, Texas. Jason and Heather will share their biggest surprises from this game-changing research and provide key action items to keep your messaging and methods on point for each generation. They will also be joined at the event by direct selling and social selling executives.

With 20+ years of cross-functional experience in direct selling, Heather Chastain brings a solid understanding of sales, marketing, technology, manufacturing, operations and C-Suite challenges as well as a strong collaborative and relational style of leadership to the table. Heather has held executive roles at Shaklee, Arbonne International, Celebrating Home and BeautiControl. Heather also serves as the Strategic Advisor at DSN and is the Founder & Chief Executive Officer of Bridgehead Collective.

From the May 2023 issue of Direct Selling News magazine.